As I said on the previous page, you can find my QuickBooks Manual Payroll Setup on eBay. Here's a link to that....

(copy and paste)

http://www.ebay.com/itm/2012-QuickBooks-Pro-Manual-Payroll-Setup-Service-/200777016615?pt=US_Office_Business_Software&hash=item2ebf3e2527

but if it doesn't work, just search for QuickBooks Manual Payroll Setup and I'm sure you'll find me.

To buy this Now:

Email me at: mooncaat@earthlink.net

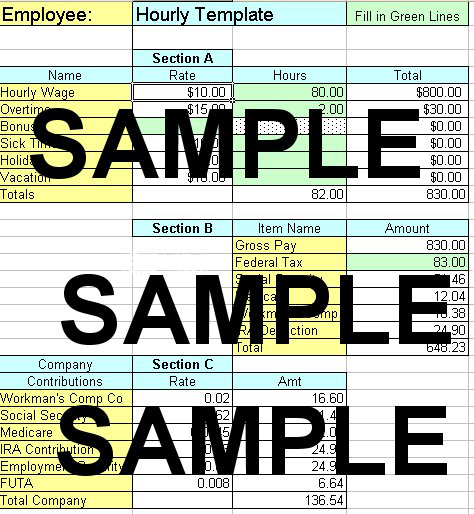

The format mirrors QuickBooks input screen, so it's easy to do manual payroll. Each payday you change only the green boxes, entering the hours worked, use your Federal Circular E to look up the income tax, and the spreadsheet does the rest. Print it and enter the figures into the QuickBooks payroll screen manually. See the sample template in the picture. Four templates are provided for Hourly, Salary Monthly, Salary Bi-Weekly, Salary Semi-Monthly as well as detailed setup and operational instructions. The spreadsheet does not keep track of YTD information because QuickBooks will still do that for you. You will still be able to do your 941's, 940's and W-2's on QB's.

WHAT YOU ARE BUYING: You are buying an Excel spreadsheet that I created which I will email you upon payment. There is no shipping, as nothing will be snail-mailed, but there IS sales tax in Washington State. I'm a bookkeeper, I have to follow the rules! Please email me with any questions. Assumption is made that the buyer owns and knows how to use Microsoft Excel at least a little (all formulas are in place already). Thanks!

1. How does it handle State Income Tax? If your state has income tax, I can (or you can) add a line just below the Fed Tax deduction in Section B (see picture), then you look it up in a booklet just like the Fed Tax. If it's a percentage of gross you can automate it.

2. Will I need to purchase Quickbooks Standard Payroll with this, or will it work with just a Quickbooks Premier edition? It'll work with any version of QB's that will do payroll. You just don't need to purchase the payroll tax tables for $230 each year.

3. Will I have to update with you each year? No, that's the beauty of this - never update QB's again, EVER. The only things that change each year are your company's rates, and you can change those yourself - or email me and I can help if you like. I'll be around, and my email address is in the instructions on the spreadsheet.

InfoWorld 4/30/2001

Twist in Intuit's crippleware techniques doubles the cost of its tax-table

service - Ed Foster, InfoWorld

Software marketeers would do well to study the saga of QuickBooks and

its zeroed-out tax deductions. It provides a textbook example of the creative

use of crippleware to squeeze some extra dollars out of customers. To

understand the final twist Intuit has written into the last chapter of

the QuickBooks story, we must first review what's happened previously.

On Feb. 15, 1999, many QuickBooks 6.0 customers were startled to find

their tax deduction data for payroll checks had been zeroed out. To have

the program continue calculating the deductions, QuickBooks users were

required to subscribe to Intuit's $59.95 tax-table service to get the

latest federal and state updates. The user could calculate and enter the

deductions manually for each check, but every month QuickBooks would again

zero out the data. Some QuickBooks users, particularly very small businesses

with a handful of employees, felt the crippled payroll feature was intended

to force them to sign up for a service they didn't need. Intuit officials

argued it was all for customers' own good; that is, without the tax-table

updates, users risked being penalized for missing changes to the tax regulations.

But Intuit's argument seemed hypocritical, particularly considering it

did not guarantee the accuracy of the updates. Even tax-table service

subscribers were ultimately responsible for checking that they were in

compliance with new withholding regulations; they were essentially paying

an extra $60 per year just to have a basic feature of the program actually

work.

QuickBooks has continued to zero out payroll deductions for customers

who have yet to subscribe to the tax-table service. Last year the cost

of annual subscription, now called the Basic Payroll service, crept up

to $72. But as tax time rolled around this year, The Gripe Line once again

heard a chorus of complaints from QuickBooks customers who felt they were

being squeezed. And that certainly seemed to be the case because the price

of the Basic Payroll subscription shot up to $129.95. "Their letter doesn't

even attempt to justify bumping up the price by 80 percent," wrote one

reader after receiving a letter from Intuit announcing the new price for

the tax-table updates. "They figure they have us over a barrel, and they

mean to take advantage of it. I can't believe it's legal for them to do

this. How can they charge you an annual fee just so a product will work

as advertised?" "$129.99 isn't going to kill me, but I sure don't like

being held hostage," wrote another reader. "And I like terrorists even

less. I hate losing a battle, but I'm afraid Intuit has me. I have got

to pay. Hundreds of hours are tied up in that accounting. I have no choice.

Is this extortion? Protection money, maybe?"

We've heard this before, but one aspect of this year's gripes intrigued

me. Several readers who'd called Intuit to complain reported its customer

service told them that upgrading to QuickBooks 2001 for $89.95 would solve

the problem. The information the readers received was not crystal clear,

but the basic message seemed to be that the new version of the program

would no longer zero out the user's manually entered data every month.

Searching Intuit's Web site suggested this might be the case, as a note

in several places said that QuickBooks 2001 users could "continue to use

the last payroll tax table received or subscribe to basic payroll." Had

Intuit finally seen the light? It would hardly be surprising that they

would avoid being blunt enough to make such a reversal of policy clear

-- "No More Crippleware" isn't a slogan most ad copywriters are likely

to adopt, after all. An Intuit spokeswoman confirmed that QuickBooks 2001

does allow users to keep using the tax table that comes with the program.

Users who do not subscribe to the payroll service will not have their

deduction data zeroed out. As for raising the price of the subscription

to $129.95, the spokeswoman said this was done to put Intuit's pricing

in line with that of its competitors for similar services.

Cynics might wonder if it was coincidental that the price of the tax-table

service was pushed up significantly higher than the price of upgrading

to QuickBooks 2001. But it seems like a good way of encouraging the customer

base to buy an upgrade some might not otherwise find attractive. It's

a clever strategy: First you cripple a product, then you sell an uncrippled

version as an upgrade. Could that have been Intuit's thinking all along?

Perish the thought, but it did raise a question in my mind that inspired

me to ask the Intuit representative to do some more checking. Sure enough,

QuickBooks 2001 will let you use the old tax table, but only in 2001.

On Feb. 15, 2002, it starts zeroing out users' payroll deductions again,

and our crippleware story starts again. Pardon me, but I've already read

this book.

Ed Foster is a contributing editor at InfoWorld.

Note: Intuit now charges $230 a year for payroll tax tables, which is a 337% increase over it's initial price in just five years. What a scam!!

Don't be a sheep too!!